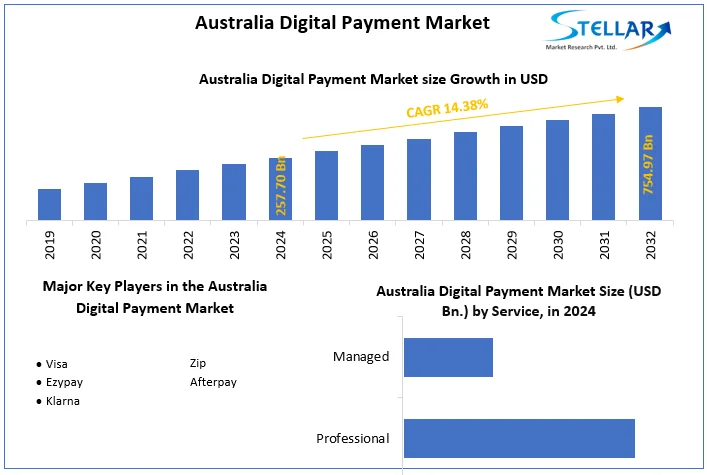

Australian Digital Payment Market Size To Grow At A CAGR Of 14.38% In The Forecast Period Of 2025-2032

Australia Digital Payment Market Outlook: Market Estimation, Growth Drivers, Segmentation, and Competitive Landscape

The Australia digital payment market is witnessing significant growth as consumers and businesses increasingly adopt cashless and electronic financial solutions. Digital payments, which include mobile wallets, online banking, card-based transactions, and contactless payment methods, are transforming the country’s financial landscape. Rising smartphone penetration, robust internet infrastructure, and strong government support for cashless transactions are key factors driving widespread adoption across retail, banking, and service sectors.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Australia-Digital-Payment-Market/1577

1. Market Estimation & Definition

Digital payments refer to financial transactions conducted electronically, eliminating the need for cash. The Australian market encompasses a range of solutions such as payment gateways, mobile wallets, point-of-sale (POS) systems, online banking platforms, and contactless payment technologies. These solutions serve individuals, retailers, financial institutions, and public service providers, enabling secure, fast, and convenient transactions. The market is expanding rapidly due to rising consumer demand for efficient, seamless, and secure payment experiences.

2. Market Growth Drivers & Opportunities

Several factors are propelling the growth of the digital payment market in Australia:

Strong Smartphone and Internet Penetration: Widespread adoption of mobile devices and high-speed internet facilitates mobile and online payments.

Increasing E-Commerce Adoption: Growth in online shopping is driving demand for secure, convenient digital payment solutions.

Government Support and Regulations: Policies promoting financial inclusion, secure payments, and cashless transactions boost market confidence.

Consumer Preference for Cashless Transactions: Australians increasingly prefer mobile wallets, contactless cards, and digital banking over traditional cash.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

sales@stellarmr.com

Australia Digital Payment Market Outlook: Market Estimation, Growth Drivers, Segmentation, and Competitive Landscape

The Australia digital payment market is witnessing significant growth as consumers and businesses increasingly adopt cashless and electronic financial solutions. Digital payments, which include mobile wallets, online banking, card-based transactions, and contactless payment methods, are transforming the country’s financial landscape. Rising smartphone penetration, robust internet infrastructure, and strong government support for cashless transactions are key factors driving widespread adoption across retail, banking, and service sectors.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Australia-Digital-Payment-Market/1577

1. Market Estimation & Definition

Digital payments refer to financial transactions conducted electronically, eliminating the need for cash. The Australian market encompasses a range of solutions such as payment gateways, mobile wallets, point-of-sale (POS) systems, online banking platforms, and contactless payment technologies. These solutions serve individuals, retailers, financial institutions, and public service providers, enabling secure, fast, and convenient transactions. The market is expanding rapidly due to rising consumer demand for efficient, seamless, and secure payment experiences.

2. Market Growth Drivers & Opportunities

Several factors are propelling the growth of the digital payment market in Australia:

Strong Smartphone and Internet Penetration: Widespread adoption of mobile devices and high-speed internet facilitates mobile and online payments.

Increasing E-Commerce Adoption: Growth in online shopping is driving demand for secure, convenient digital payment solutions.

Government Support and Regulations: Policies promoting financial inclusion, secure payments, and cashless transactions boost market confidence.

Consumer Preference for Cashless Transactions: Australians increasingly prefer mobile wallets, contactless cards, and digital banking over traditional cash.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

sales@stellarmr.com

Australian Digital Payment Market Size To Grow At A CAGR Of 14.38% In The Forecast Period Of 2025-2032

Australia Digital Payment Market Outlook: Market Estimation, Growth Drivers, Segmentation, and Competitive Landscape

The Australia digital payment market is witnessing significant growth as consumers and businesses increasingly adopt cashless and electronic financial solutions. Digital payments, which include mobile wallets, online banking, card-based transactions, and contactless payment methods, are transforming the country’s financial landscape. Rising smartphone penetration, robust internet infrastructure, and strong government support for cashless transactions are key factors driving widespread adoption across retail, banking, and service sectors.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Australia-Digital-Payment-Market/1577

1. Market Estimation & Definition

Digital payments refer to financial transactions conducted electronically, eliminating the need for cash. The Australian market encompasses a range of solutions such as payment gateways, mobile wallets, point-of-sale (POS) systems, online banking platforms, and contactless payment technologies. These solutions serve individuals, retailers, financial institutions, and public service providers, enabling secure, fast, and convenient transactions. The market is expanding rapidly due to rising consumer demand for efficient, seamless, and secure payment experiences.

2. Market Growth Drivers & Opportunities

Several factors are propelling the growth of the digital payment market in Australia:

Strong Smartphone and Internet Penetration: Widespread adoption of mobile devices and high-speed internet facilitates mobile and online payments.

Increasing E-Commerce Adoption: Growth in online shopping is driving demand for secure, convenient digital payment solutions.

Government Support and Regulations: Policies promoting financial inclusion, secure payments, and cashless transactions boost market confidence.

Consumer Preference for Cashless Transactions: Australians increasingly prefer mobile wallets, contactless cards, and digital banking over traditional cash.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

sales@stellarmr.com

0 Comentários

0 Compartilhamentos

63 Visualizações

0 Anterior